Axis Multi Asset Allocation Fund - Regular Plan - Growth Option

Invest Now

Fund Manager: "Mr. Ashish Naik, Mr. Devang Shah, Mr. Hardik Shah, Mr. Aditya Pagaria, Mr. Pratik Tibrewal, Ms. Krishnaa N (For Foreign Securities) " |

Hybrid: Multi Asset Allocation |

NIFTY 500 TRI(65.00), NIFTY Composite Debt Index(20.00), Domestic Price of Gold(7.50), Domestic Price of Silver(7.50)

NAV as on 16-01-2026

AUM as on

Rtn ( Since Inception )

10.23%

Inception Date

Aug 01, 2010

Expense Ratio

1.97%

Fund Status

Open Ended Scheme

Min. Investment

100

Min. Topup

100

Min. SIP Amount

100

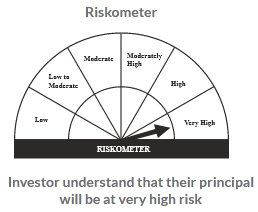

Risk Status

very high

Investment Objective : The Scheme seeks to generate long term capital appreciation by investing in a diversified portfolio of equity and equity related instruments, debt and money market instruments, Exchange Traded Commodity Derivatives / Units of Gold ETFs, Silver ETF & units of REITs/InvITs.